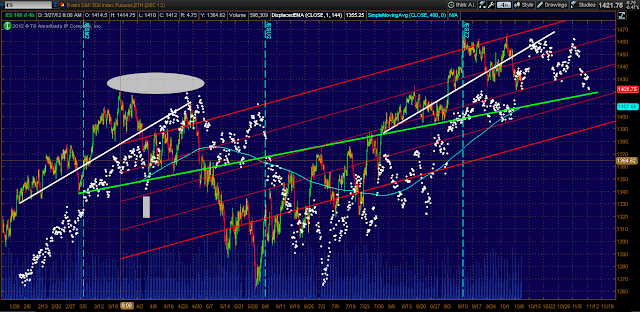

Takeaways from the chart below:

- We are testing the dotted white FLD (future line of demarcation)...1st time since April of this year, which I've highlighted with an Oval above the price action. A meaningful break will confirm that the trend has turned, and at current levels, using Hurst projection methods, 1375 is our preliminary target...over the course of TIME. If this is in fact the final phase of a larger degree 80-week cycle, I would expect that downside target to be overshot. Again, we're talking about the next 20 weeks or so, so there's a lot of time ahead of us.

- I also marked a rectangle on the chart...which is our analog reference analog point for the current cycle. You'll see in April (right at the start of Q1 earnings season), we found support at the 400 period moving average. Currently, that moving average resides at ~1408 on the futures, about 1415 cash equivalent. Coincidental or not, that's also where the delineating bull/bear trendline (lime green) starting in March of this year comes in. If/when we test that trendline, I'm expecting some sort of bounce. Since this is the possibly the last phase of a larger cyclical downturn, my thinking is that the bounce will not be as strong as the early April to late April rally...i.e. larger degree cycle in its late stages could be the most bearish wave pricewise.

- Finally, I've drawn 2 white trendlines (duplicates of one another) to compare the April top to the current. Time-wise, after the current selloff ends, I'm guessing some sideways / sideways-up price action into November...perhaps the powers that be hold it up into the Thanksgiving timeframe. But currently and always subject to change, Dec/Jan not looking like favorable periods to be in the market.

No comments:

Post a Comment